Polish grain for Morocco

The mission began with the conference "Polish Grain - potential and prospects for Morocco", which was attended by Moroccan Government Institutions, sectoral federations, private importers and Polish exporters. Mohammed Sebgui, director of ONICL's main grain regulator, stressed during the event how important it is to strengthen relations with countries that have production surpluses, especially at a time of changes in global supply chains and another year of severe drought in the region. The President of the Comader confederation, Rachid Benali, pointed to the possibilities of expanding cooperation not only in the grain sector, but also in the fruit and vegetable sector.

The conference was an excellent opportunity to promote Polish agri-food potential and discuss the possibilities of expanding cooperation between Poland and Morocco. The mission’s participants also had the opportunity to hold numerous face-to-face meetings and field visits, during which they visited the largest Moroccan grain importers, who account for the majority of domestic imports: Zine Capital Invest, Anouar Invest, Cap Holding, Gromik, Izda, Alf Sahel.

Moroccan bread

Moroccans import about 10 million tons of grain a year, including almost 5 million tons of wheat. There are private entities operating in the sector, but the market is heavily regulated. Customs duties are periodically introduced to protect local crops or to subsidise imports of grain to ensure supplies within fixed prices. The Government of the Kingdom of Morocco sets a fixed price for bread at 1.20 dirhams, which is why the price of flour (350 dirhams/q) and grain (260 dirhams/q) are also regulated. Last year, the very high price of wheat in the world, periodically reaching up to 600 EUR/t, meant that state subsidies reached more than half of the value of imports. Despite this, Morocco has not raised the price of bread and even in the context of rampant inflation, this basic element of the daily diet has not become more expensive. Until the end of May of this year, importers could benefit from subsidies - many increased orders and stocked up to ensure uninterrupted delivery to mills for the coming months. Currently, the time of assessment of domestic harvests is underway, subsidies have been suspended, and further import subsidy programs are expected in August this year.

Drought

Grain production in the Kingdom of Morocco accounts for almost 1/4 of the value of all agricultural products and occupies as much as 71% of the country’s area. The wheat yield in Morocco is no more than 4 t/ha (almost three times less than in Poland), and the total harvest can on average reach about 3 million tons. Currently, however, little of the native harvest goes to the central mills due to very poor yields, which are practically enough only for direct consumption and animal feed.

Moroccan mills

The Moroccan milling sector is very well organised and efficient. Moroccan companies have extensive facilities in the field of grain storage, infrastructure for the production of flour, couscous, cookies and pasta. Companies such as Zine or Anouar grind about 50,000 tons of grain per month and value Polish wheat due to, its high protein content and quality of supply, treating it as a desirable premium product.

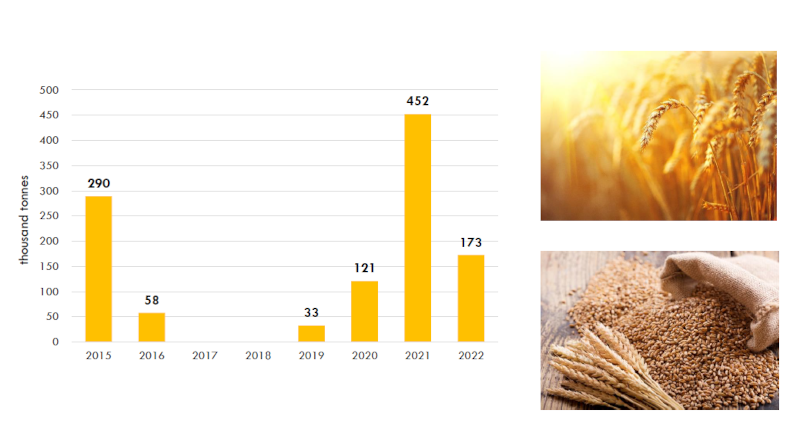

Export to Morocco

Since 2020, when customs duties were abolished, Polish wheat exports to Morocco have noted record results - in 2021 it was almost half a million tons. By May of this year, imports amounted to 128 thousand tons. France and Germany are still the largest suppliers, supplying 3.1 and 1.2 million tonnes respectively to the Moroccan market last year. The main destination is Casablanca, but grain is also unloaded in Tangier, Nador, Agadir and Jorf. The latter is currently the only port in Morocco adapted to cargo weighing 60,000 tons - work is underway to adapt the port of Casablanca as well. Grain is mostly exported by global intermediaries and exporters such as Dreyfus, ADN or Viterra.

Opportunities for Poland

Entities that are able to offer a comprehensive and competitive offer not only in the context of the best quality of goods, but also for transport and financing have a chance to enter the Moroccan market. Especially today, in a difficult geopolitical and climate context, we encourage Polish entities to expand into non-European markets and develop the possibilities offered by th Moroccan market. We note a very high interest from the Moroccan side and we hope that Polish companies will respond positively to this.

A few days after the Polish mission, ONICL published a circular concerning subsidies for wheat imports in the period from July 1 to September 30 this year, in the maximum amount of 25 million quintals (2.5 million tons). Aid will be granted if the import price of grain exceeds 270 dirhams (approx. EUR 25) per quintal.